Should a Startup Raise Funding and When

Oct 28, 2022 • 8 min read

In our conversations with aspiring and early tech entrepreneurs the topic of fundraising surfaces frequently. For the aspiring tech entrepreneur it is a question of how to bridge the gap between a steady paycheck and success in entrepreneurship, which we’ve already discussed at length. At the same time, for the ones that have already started, it is a matter of how to have a long enough runway in order to have the needed time and resources to build the business.

Fundraising has a lot of underlying factors that need to be considered and it is dependent on both availability of options and personal preference. The whole topic requires a book on its own and while in this article we are not going to aim for completeness, I believe that you will get enough information to start shaping your own thinking about funding. Let’s go!

Bootstrapping vs Raising Funding

Bootstrapping in simple terms means to start a company without seeking external funding. It is about building a startup with whatever money you have on hand and from customer revenues. Way too often bootstrapping is confused with self funding. The essence of bootstrapping is to fund the company with the profits you earn.

On the other hand, raising funding is when you seek out external capital from investors who are typically Angel Investors or Venture Capitalists (VCs). Such investors provide you with capital in exchange for equity in your company.

Bootstrapping pros and cons:

- Flexible timelines, but fewer resources.

- Higher ability to pivot, but slower growth.

- Full ownership and control, but lack of vested support network to consult with.

- More financial discipline, but hard to or impossible survive in the competitive market.

Raising funding pros and cons:

- More resources, but rigid timelines.

- Faster growth, but lower ability to pivot.

- Great vested support network to consult with, but lack of full ownership and control.

- Ability to survive in a competitive market, but less financial discipline (i.e. you won’t make the most of the available money compared to if you had less).

It is important to keep in mind that these two strategies are not mutually exclusive. As an example you can start with bootstrapping your company and then at a later stage get external investment.

OK, now that we know the high-level differences between bootstrapping and raising funding let’s move to the next question and explore if there are businesses that are more suited for bootstrapping than others.

The Two Types of Entrepreneurship

In his seminal work “Disciplined Entrepreneurship: 24 Steps to a Successful Startup”, Bill Aulet, Professor @ MIT, points out that when we say “entrepreneurship”, it could mean at least two different things: Small and Medium Enterprise (SME) Entrepreneurship and Innovation-Driven Enterprise (IDE) Entrepreneurship.

SME Entrepreneurship:

- Focus on addressing local and regional markets only.

- Innovation is not necessary to SME establishment and growth, nor is competitive advantage.

- “Non-tradable jobs” - jobs generally need to be performed locally (e.g. service industry).

- Most often family business or business with very little external capital.

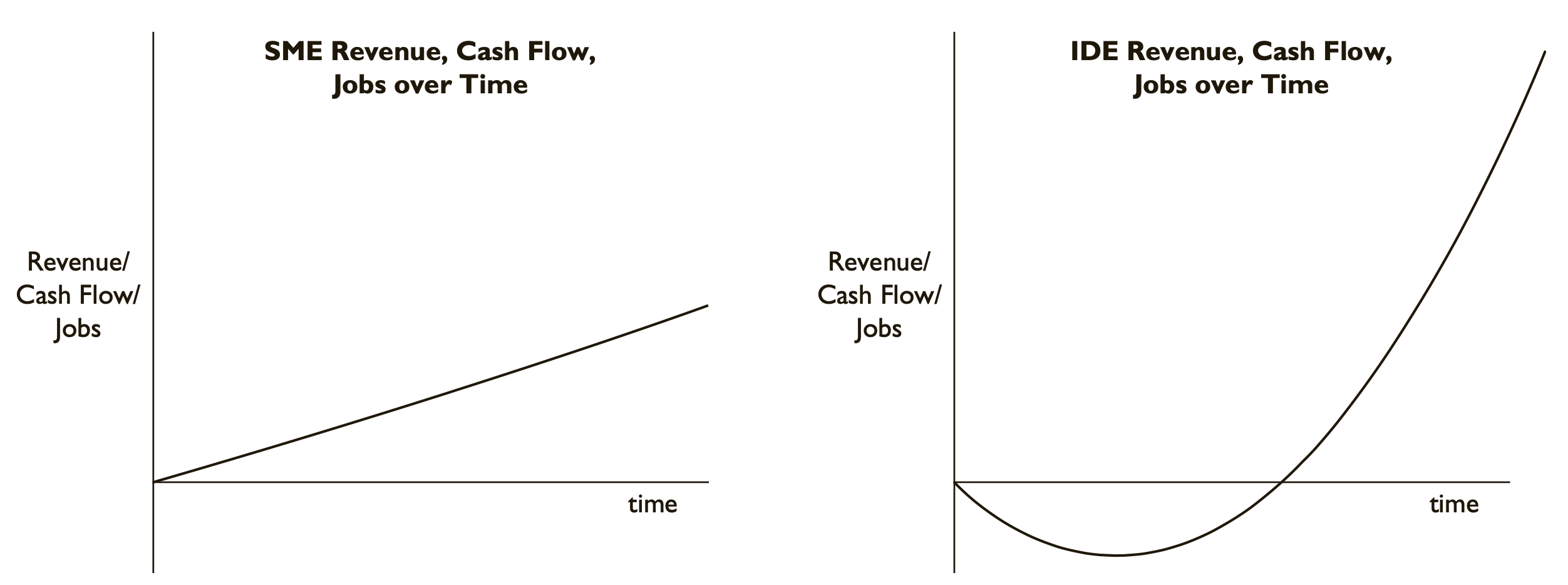

- The company typically grows at a linear rate. When you put money into the company, the system (revenue, cash flow, jobs, etc. ) will respond quickly in a positive manner.

IDE Entrepreneurship:

- Focus on global/regional markets.

- The company is based on some sort of innovation (tech, business process, business model) and potential competitive advantage.

- “Tradable jobs” - jobs that do not have to be performed locally.

- More diverse ownership base including a wide array of external capital providers.

- The company starts by losing money, but if successful will have exponential growth. Requires investment. When you put money into the company, the revenue/cash flow/jobs numbers do not respond quickly.

Here is a comparison of the revenue growth of the two types of companies:

Source: Bill Aulet and Fiona Murray, “A Tale of Two Entrepreneurs: Understanding Differences in the Types of Entrepreneurship in the Economy"

Let me give you examples for each. Consider a custom software development services company. Typically such companies are essentially selling the time of their employees to build these one off requests. This means two things. On the one hand, the company can start making money immediately - as long as we have a customer, we can start charging for our time at a given hourly rate. On the other hand though, the limiting factor of growth of such businesses is the number of employees. This means that if we want to make more money, we need to hire more people. And that’s why the revenue trajectory is linear and is directly proportional to the number of employees. That is also the reason why such companies have constant and relatively small profit margins. That is an example of a SME Entrepreneurship.

Now let’s contrast that with a software product company. Such companies sell their digital products. Again this means two things. On the one hand, in order for the company to start generating revenue they need to build their product. That takes time and money. On the other hand, once a product company gets to product/market fit, then the growth trajectory is typically exponential as they can sell their digital product an infinite number of times. That’s why such companies, unlike the custom software development services one, can have huge profit margins. That is an example of an IDE Entrepreneurship.

Up to now it should be clear why we are talking about these two types of entrepreneurship in the context of bootstrapping and raising funds. The SME companies are often perfectly suited for bootstrapping as you can start making profits right off the bat. I’m not saying it is easy, just that it is possible. At the same time such companies are not always a good option for VC funding as VCs are typically looking for investing in businesses with potential for exponential growth.

On the other end of the spectrum if we look at the IDE companies to get to profits, they need resources. If they want to grow at a rapid pace, they need even more resources. Such companies are ideal for VC funding.

“OK, Vesko! But still… when to bootstrap and when to raise funding?” Glad you asked!

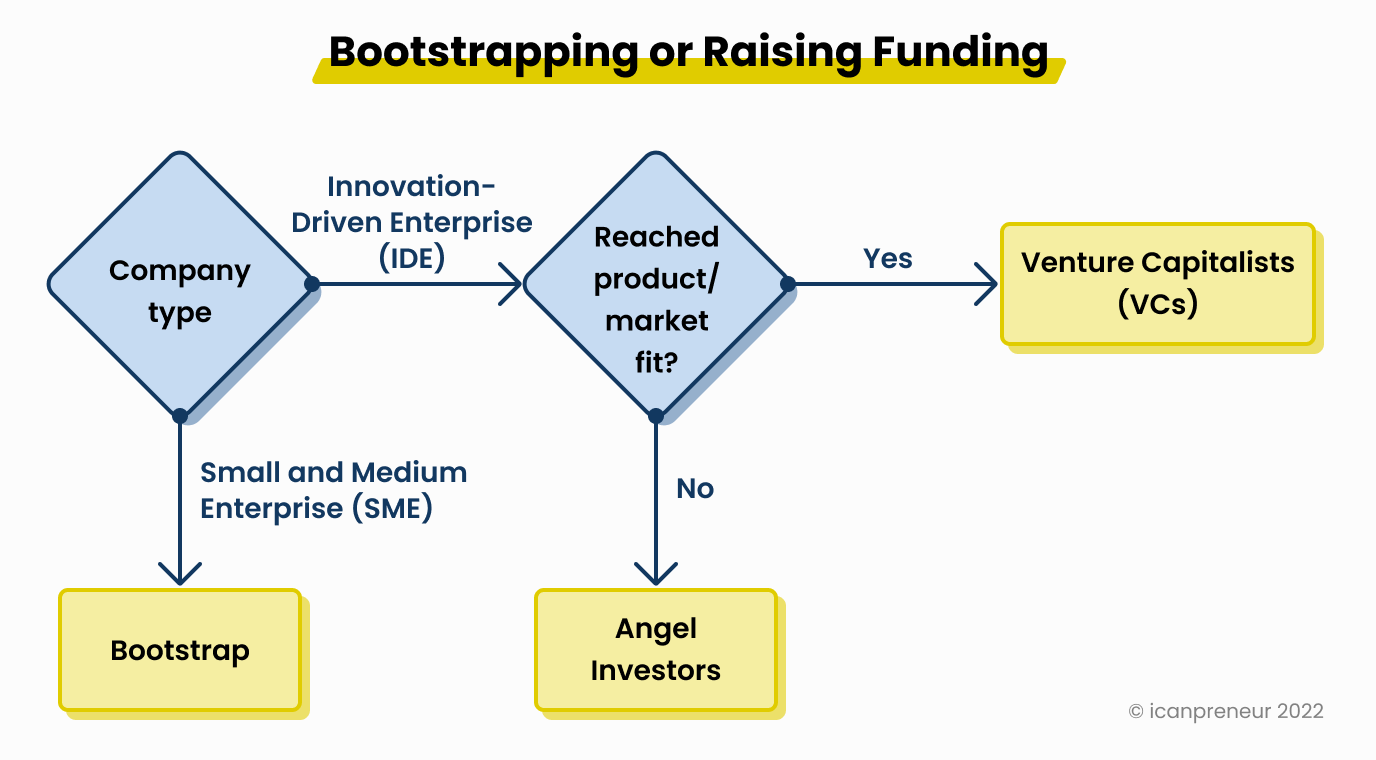

When to Bootstrap and When to Raise Funding

If you are starting a SME company, bootstrapping is more often than not the right option.

If you are building a product company (IDE) then there is a right time for bootstrapping and there is a right time for external funding. The key milestone is product/market fit. Broadly speaking product/market fit is the point in the development of your company where you have built a great product that creates significant customer value for a big enough market. In the beginning the sole existence of a startup is to transform their initial idea to a working business model and get to product/market fit. That is achieved through learning. In other words the measure of progress for a startup before P/M fit is learning. When that milestone is achieved, then the goal is growth.

What about the investors? Investors measure progress differently. The goal of investors, especially VCs, is growth. They are first and foremost investing their funds’ money in order to make 5x-10x returns.

The best time to raise funding is after product/market fit as at that time both you and your investors have aligned goals - to scale your business. The second best time? As close to product/market fit as possible!

What if You Need Money Earlier

In case you need money before you have gotten to product/market fit then look for angel investors. Look for people in your network that are passionate about the space that you are in and the impact that you aim to make. These people are often interested in more than just making money. Some do it because they care about the cause, some because they care about the team, some because they want to learn how to be good investors. Making money along the way is a great side effect of the journey of being an angel investor.

How to Get To Product/Market Fit?

We’ve already shared our view on what is the #1 root cause 9 out of 10 startups fail. It is because a lot of entrepreneurs rely solely on luck and gut feeling which is especially inefficient in the phase between idea and product/market fit.

Our goal at icanpreneur is helping aspiring and early tech entrepreneurs who want to build software product companies (IDEs), to go from idea to product/market fit in a systematic way instead of relying purely on luck and gut feeling. If you want to go from idea to investment with significantly improved odds of success, sign up now!

Author

Founder & CEO of Icanpreneur. Passionate about connecting people with their purpose of becoming successful entrepreneurs.