Demystifying the Startup Funding Rounds

Nov 4, 2022 • 9 min read

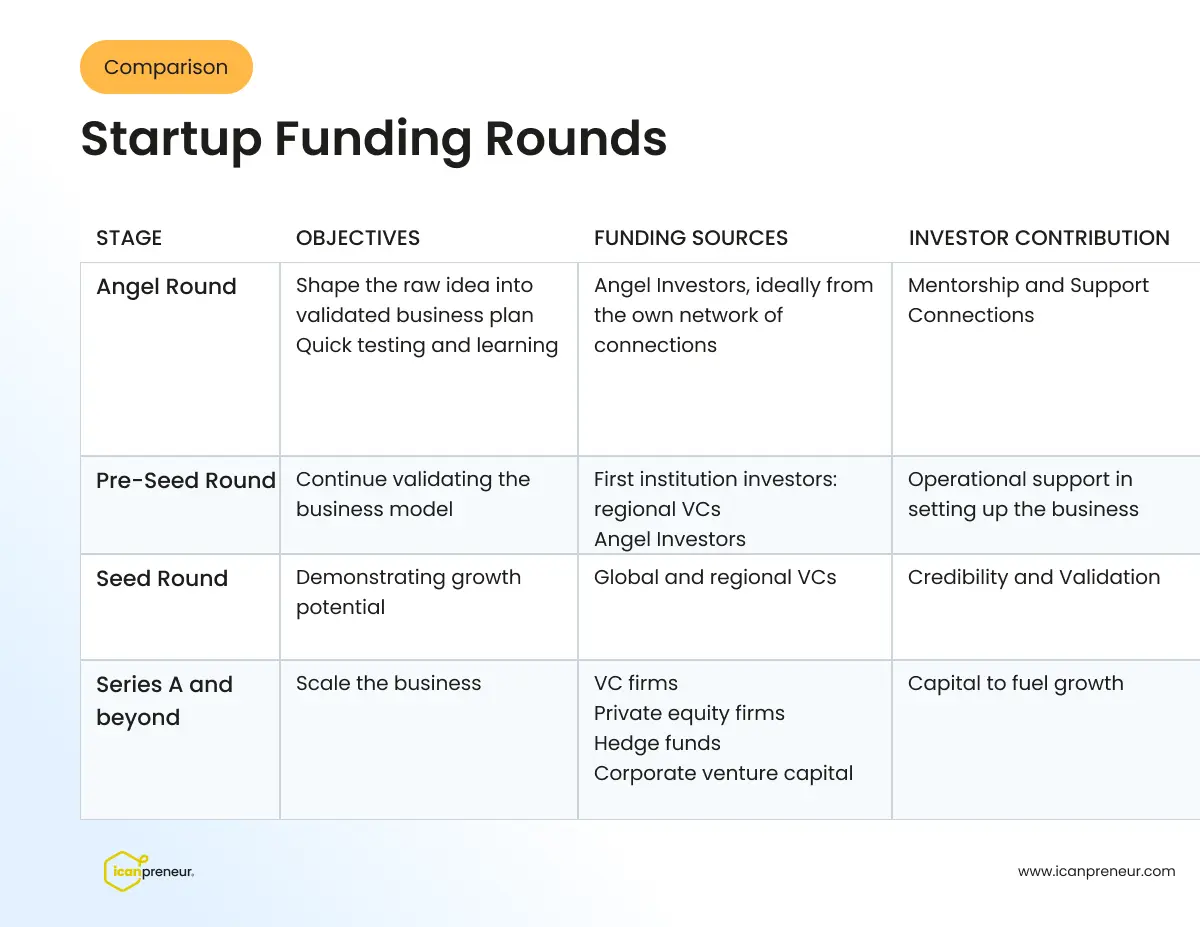

Way too often, in our conversations with aspiring and early-tech entrepreneurs, we see a huge knowledge gap regarding fundraising. In our previous article, we discussed at length whether a startup should raise funding at all and, if yes, under what circumstances.

We talked about the startups that are suitable for bootstrapping and ones that are better off with raising capital. Now, we will focus on providing some clarity on the different startup funding rounds, and by the end of this article, you should have gained enough practical understanding of how to think about them. Let’s go!

Angel Round

An angel round is typically the first round that enables a startup to get off the ground. It is for startups in a very early-stage with unproven ideas and has a high risk/reward ratio. Investors in such rounds can be individual angel investors, angel investor groups, friends and family. Angel investors are usually high-net worth individuals who, unlike venture capital firms, invest their personal money and time in very early-stage startups in exchange for equity.

Here are a few key questions to keep in mind when considering an angel investment:

-

What is your motivation for getting an angel investment? Ideally, you won’t get an angel investment just for the money. Yes, money is needed, but mentorship, advice, support, and connections are even more important for your success. With that in mind, focus on winning over reputable angels who can bring specific experience and connections relevant to the field of your startup.

-

What is the motivation of each of your angel investors to invest? Make sure you understand why every individual angel wants to invest in your startup.

Is it because they want to make money? Is it because they relate to the mission of your startup? Is it because they want to invest in you?

The best angel investors are the ones who focus on creating value and getting a return as a result of that. Why?

At this stage, the goal of the startup is to learn how to discover a working business model. Suppose the investor is focused on quick returns; that puts the focus on scaling. Prematurely scaling a business model that doesn’t work yet, i.e., a business model with a problem, scales the problem.

-

How much dilution is OK for an angel round? By definition, dilution (or share dilution) is the decrease in the ownership percentage of existing shareholders when new shares are issued or reserved. An angel round can have a ballpark dilution range of ~10%-20%, i.e.; the founders forfeit that percentage of ownership.

Angels invest in your startup while at the same time you are also investing in them. The difference is that they invest their money, time, network, etc., while you are investing a portion of your company in them. We will get back to you later as to why the percentage range is such.

-

How many individual angels should you aim to get? The more good angels who have a meaningful vested interest, the better. This means that here, you should aim to maximize the number of angels that you get onboard, as that will increase your support network.

At the same time, you should make sure that each of them is vested enough in terms of equity. Even though their first focus does not return, having a decent potential return will ensure they prioritize their time investment in your startup properly.

-

Old-economy angels vs New-economy angels? Old-economy angels are people coming from corporations (i.e., former board members of listed companies, high-level executives, key employees within corporations, etc.). They can serve well as door openers to decision-makers in corporations.

New-economy angels, on the other hand, are founders or key members of already successful or exited scaleups. They are good at helping you with product/market fit and scaling-related topics. Typically, a good mix of both types of angels is the best choice as it gives you access to a wide range of potential support, but you have to assess that on your own based on your specific case.

OK, let’s move to the next type of funding round.

Pre-Seed Round

As the name suggests, a pre-seed round happens before a seed round which we will cover shortly. Pre-seed round is a relatively new type of round and you can think of it as an angel round but with the presence of an institutional fund. It is the first external institutional money invested in pre-revenue startups. This means that the money for a pre-seed round is taken typically from a combination of a venture capital fund and angels.

Although there isn’t a strict set of rules on when a startup is ready for a pre-seed round, here are some guidelines around what should be ready:

- A fully committed team

- A precise idea of what market you aim to address and how

- An MVP or beta product

- A clear path between you and product-market fit

- A pitch deck

Here are a few key questions to keep in mind when considering pre-seed investment:

-

How much dilution is OK for a pre-seed round? Ideally a pre-seed round + the angel round total dilution should have a ballpark range of ~10%-20%. We will get back later why the percentage range is such.

-

How do you select a VC or Private Equity Firm? A good investor to get on board is one who has a track record of investing in startups at that stage. As we’ve discussed already, the goal of a startup in a pre-product-market fit stage is to discover a working business model that is different from scaling. That means that the KPIs (Key Performance Indicators) here are completely different from the ones in the scaling phase.

The pre-product-market fit phase is about measuring the progress of validated learning. After achieving product-market fit, it is about the amount of revenue, customers, margins, etc. Given that, ideally, the fund should offer operational support specifically for that stage. Another key factor is the size of the fund - it should be a maximum of 60-80M so that the ticket in your company is meaningful to them and not just a rounding error.

-

How much should you take from VC, and how much from angels? Let’s say the round is 500K. Ballpark, a good round composition would be 350K-400K from a pre-seed VC and 100-150K from angels (half old economy, half new economy). That being said, if you are an industry veteran/repeating startup founder and can raise a bigger pre-seed round (e.g., 1M+), it is also possible to have 2VCs, ideally from different ecosystems and networks.

Seed Round

Seed funding is the investment that a startup gets for R&D, sales and marketing activities, hiring, and developing the product. While the goal of pre-seed funding is to get to product-market fit, seed funding helps you demonstrate you can grow and scale your business. The basic requirement for this stage on top of the requirements from the pre-seed stage, would be to have a product that has some traction and data to demonstrate you have achieved product-market fit at least to some extent.

Series A Round… Or When You Become a Scaleup

The goal of Series A funding is to inject money into the business so that the company can pay employees and optimize offerings on both the product and the go-to-market side, with the goal of scaling across different markets and ensuring continued growth. A startup that gets successfully to a Series A investment generally moves to the scaleup territory. This means that all follow-up rounds of investment are beyond the startup phase.

How Much Dilution Is OK in Each Startup Funding Stage?

As there is a lack of enough public data for pre-seed and angel rounds, we can reverse engineer the acceptable dilution ranges based on the known patterns of the later rounds instead of relying on gut feeling.

- Typically, a healthy post-Series A ownership of the Founding Team + ESOP (Employee Stock Ownership Plan) would be at 55%+ (data from Index Ventures). This leaves enough in the stock pool for Series B funding, Series C round, etc.

- Series A average dilution is ~20%-25%

- Seed average dilution is ~15%-20%

- As a result, a pre-seed round + angel round should have a ballpark dilution range of ~10%-20%

One More Thing

Don’t confuse getting an investment with being a successful entrepreneur. The only real validation of entrepreneurial success is 1) getting your startup to product-market fit and then 2) scaling it successfully. Getting from idea to product-market fit is where most startups fail, and they fail because most entrepreneurs rely solely on luck and gut feeling.

At icanpreneur, we aim to change that by helping aspiring and early tech entrepreneurs go from idea to product-market fit in a systematic way instead of relying purely on luck and gut feeling.

FAQ

There is no hard rule for when to go public. You can have multiple rounds of funding or take no funding before IPO. Companies like Airbnb and Uber raised more than ten rounds of funding from different types of investors before their initial public offering.

There are some factors to consider when picking the right time for an IPO:

- Strong Financial Performance: in order to attract venture capitalists and make a successful IPO, you need to demonstrate healthy financials;

- Market Readiness: investors at this stage are typically looking for strong market trends that generate tailwinds for a company to invest in it;

- Mature Business Model: a prerequisite for an IPO is to have a validated, sustainable, and scalable business model, which is part of your business planning and demonstrates growth potential.

Author

Founder & CEO of Icanpreneur. Passionate about connecting people with their purpose of becoming successful entrepreneurs.